As you navigate the complex world of tax-saving products, you're likely wondering how to maximize their benefits. You're on the right track by considering employer-based retirement accounts, individual retirement accounts, and Health Savings Accounts. But how do you strategically coordinate these products to minimize your tax liability? The key lies in understanding how each product interacts with other tax credits and deductions, such as the child tax credit or mortgage interest deduction. By optimizing your approach, you can unlock significant savings - but where do you start, and what's the most effective way to get the most out of your tax-advantaged products 即時償却

Understanding Tax-Saving Products

When it comes to tax planning, having a solid grasp of tax-saving products is essential. You'll want to understand how each product works, its benefits, and how it fits into your overall strategy.

Tax-saving products can be broadly categorized into two types: those that reduce taxable income and those that provide tax credits.

You're likely familiar with 401(k) or IRA contributions, which reduce your taxable income.

On the other hand, products like the Child Tax Credit or Education Credits directly reduce your tax liability.

Other products, such as Health Savings Accounts (HSAs) or 529 College Savings Plans, offer tax benefits for specific expenses.

You'll need to consider your income level, family situation, and financial goals to determine which products are most beneficial for you.

Coordinating Retirement Accounts

Your retirement savings strategy involves more than just contributing to a single account.

You're likely eligible for multiple retirement accounts, each with its own benefits and contribution limits. Coordinating these accounts can help you maximize your retirement savings and minimize your tax liability.

Start by considering your employment-based options, such as a 401(k) or 403(b).

Contribute enough to take full advantage of any employer matching, as this is essentially free money.

Next, look at individual retirement accounts (IRAs), which may offer additional tax deductions.

You might also consider a Roth IRA, which allows you to pay taxes now in exchange for tax-free growth and withdrawals in retirement.

Leveraging Health Savings Options

How can you shield a significant portion of your income from taxes and build a safety net for medical expenses?

By leveraging health savings options, you can do just that. If you have a high-deductible health plan, you're eligible for a Health Savings Account (HSA).

Contributions to an HSA are tax-deductible, reducing your taxable income. The funds in your HSA grow tax-free, and withdrawals for qualified medical expenses are tax-free as well.

You can also consider a Flexible Spending Account (FSA) for healthcare expenses.

While FSA contributions are limited and must be used within a specific timeframe, they're a great way to set aside pre-tax dollars for routine medical expenses like copays, prescriptions, and vision care.

Additionally, some employers offer Health Reimbursement Arrangements (HRAs), which allow them to contribute funds for your medical expenses.

Maximizing Education Savings

Take control of your education expenses by maximizing tax-advantaged savings opportunities.

You can do this by utilizing 529 college savings plans, which allow you to set aside funds for future education costs while earning interest and reducing your tax liability.

Contributions to these plans aren't subject to federal income tax, and earnings grow tax-free. Additionally, many states offer state tax deductions or credits for contributions.

You can also explore Coverdell Education Savings Accounts (ESAs), which help you save for elementary, secondary, and college education expenses.

Contributions to ESAs aren't subject to federal income tax, and earnings grow tax-free. Withdrawals are tax-free if used for qualified education expenses.

Optimizing Tax Strategies

By leveraging tax-advantaged education savings opportunities, you've taken a significant step toward minimizing your tax liability.

Now it's time to optimize your overall tax strategy. You should consider coordinating your tax-advantaged education savings with other tax-saving products, such as 401(k) or IRA contributions, to maximize your tax benefits.

This might involve adjusting your income tax withholding or making quarterly estimated tax payments to avoid underpayment penalties. You may also want to explore other tax credits and deductions available to you, such as the child tax credit, mortgage interest deduction, or charitable contribution deduction.

Remember to keep accurate and detailed records of your tax-related expenses and contributions, as these will be essential in preparing your tax return and supporting your claims in case of an audit.

Conclusion

You've got a solid foundation for maximizing tax benefits by using multiple tax-saving products strategically. Now, make sure to review and adjust your approach regularly to ensure you're taking full advantage of these opportunities. By doing so, you'll be well on your way to minimizing tax liability and securing a stronger financial future.

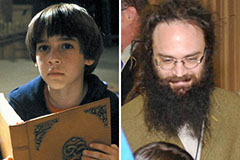

Rick Moranis Then & Now!

Rick Moranis Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!